Radiologist Salary in India 2024: Comprehensive Overview

August 18, 2024

Introduction

The demand for radiologists in India is growing rapidly due to advancements in medical imaging technology. This profession not only offers lucrative salaries but also provides job security and a variety of working environments. Understanding the factors influencing radiologist salaries is essential for aspiring professionals.

Average Salary of Radiologists

The average annual salary for radiologists in India is approximately ₹12,00,000. However, experienced professionals can earn significantly more, with salaries reaching up to ₹17,30,000. These figures can fluctuate based on various factors, including experience, specialization, and the type of employer. For those entering this field, having a clear understanding of the average salary is crucial for setting realistic expectations. In large metropolitan areas, radiologists often earn higher salaries compared to their counterparts in smaller towns, influenced by the cost of living and demand for medical services. Additionally, the type of institution—be it government, private, or academic—also plays a vital role in determining salary levels. Understanding these averages not only aids in financial planning but also helps aspiring radiologists evaluate their potential career paths.

Salary Based on Experience

Experience is a pivotal factor in determining a radiologist’s salary. For those with 0 to 5 years of experience, salaries typically range from ₹11,00,000 to ₹22,00,000. As radiologists gain experience, their earning potential increases substantially. Those with 6 to 10 years of experience can expect salaries between ₹24,00,000 and ₹50,50,000. This progressive salary increase reflects the value of accumulated skills and knowledge in the field. With more years in practice, radiologists develop a deeper understanding of complex imaging techniques and enhance their diagnostic accuracy, making them more valuable to employers. Additionally, experienced radiologists may have opportunities to take on leadership roles or specialized positions, further augmenting their earning potential. For individuals contemplating a career in radiology, it is essential to recognize the significant financial benefits that come with experience.

Specialization Impact on Salary

Specialization in radiology can greatly influence earning potential. Radiologists who choose to focus on specific areas often see differences in their salaries based on the demand and complexity of their expertise. For example, neuro-radiologists may earn around ₹4,21,000 annually, while cardiovascular radiologists can make about ₹12,06,000. Specializations such as gastrointestinal radiology tend to offer higher salaries due to the complexity and expertise required for these areas. As technology advances and new imaging modalities emerge, the demand for specialized radiologists continues to grow. Aspiring radiologists should carefully consider which specialization aligns with their interests and offers the best potential for financial and professional growth. Resources such as Radiology can provide further insights into the various specializations within the field.

Geographic Influence on Salary

Geographic location is a crucial determinant of radiologist salaries in India. In metropolitan areas like Delhi and Mumbai, average annual salaries can be significantly higher, reaching ₹11,16,000 and ₹13,06,000, respectively. This disparity arises from the higher cost of living and the concentration of advanced healthcare facilities in urban centers. Conversely, salaries in smaller towns and rural areas may be lower, reflecting the local demand for radiology services and the financial capabilities of healthcare institutions. For individuals considering a career in radiology, the choice of location should factor heavily into their decision-making process. Urban environments often provide more opportunities for advancement, specialized training, and networking, while rural areas may offer unique challenges and the chance to make a substantial impact on community health.

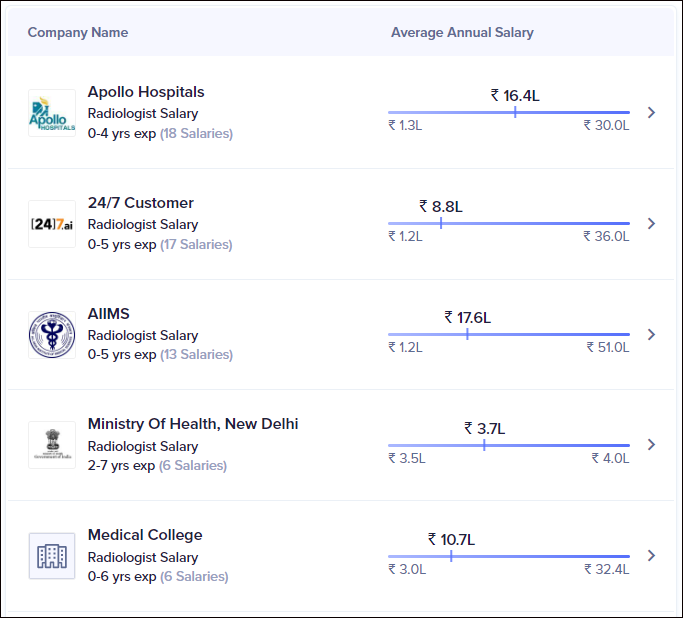

Employer Variability

The type of employer significantly affects radiologist salaries. Government institutions typically offer fixed salaries that are often lower than those in the private sector. In contrast, private hospitals and diagnostic centers can provide a wide range of compensation packages, with salaries ranging from ₹90,000 to ₹2,80,000 per month, depending on the institution’s reputation and the radiologist’s role. Additionally, academic institutions may offer salaries that are competitive but often include the added benefit of research opportunities and teaching positions. As radiologists evaluate potential employers, it is essential to consider not only the salary but also the benefits, work-life balance, and career growth opportunities each institution provides. A thorough understanding of these factors can help radiologists make informed decisions about their career paths.

Work Settings and Earnings Potential

Radiologists have the flexibility to work in various settings, including government hospitals, private clinics, and their own diagnostic centers. Each of these environments presents unique opportunities and challenges. Those who choose to establish their own centers may have unlimited earning potential, but this route often requires significant initial investment and financial risk. Working in private clinics or hospitals may offer more stability and benefits but could limit earnings compared to running a personal practice. Additionally, different payment structures, such as per-case fees or salary-based compensation, can influence overall earnings. Aspiring radiologists should carefully evaluate their career goals and consider the benefits and drawbacks of each work setting, ensuring their choice aligns with their professional aspirations and financial needs.

Challenges and Considerations

While the field of radiology offers attractive salaries, it is not without its challenges. Radiologists often face immense pressure to produce accurate diagnoses quickly, which can lead to significant stress. The rapid advancement of medical technology requires continuous learning and adaptation, adding to the workload. Moreover, navigating bureaucratic processes in hospitals can be time-consuming and frustrating. For those considering a career in radiology, understanding these challenges is crucial. The financial risks associated with starting a private practice can also deter many from pursuing this path. Therefore, it is essential for aspiring professionals to weigh the potential rewards against the demands of the profession, ensuring a well-rounded view of what a career in radiology entails.

Conclusion

Radiology remains a highly rewarding profession in India, with salaries reflecting the expertise and experience of practitioners. As the healthcare landscape continues to evolve, aspiring radiologists should consider various factors influencing their career paths, such as specialization, location, and work settings. Understanding these elements will help them make informed decisions about their futures in this dynamic field. By being aware of the average salaries, the impact of experience and specialization, and the challenges that come with the profession, aspiring radiologists can better navigate their career trajectories and maximize their earning potential. As they embark on this journey, keeping abreast of industry trends and continuing education will be vital for long-term success.

/165528739-57a92b333df78cf4597d1f80.jpg)